Table of Contents

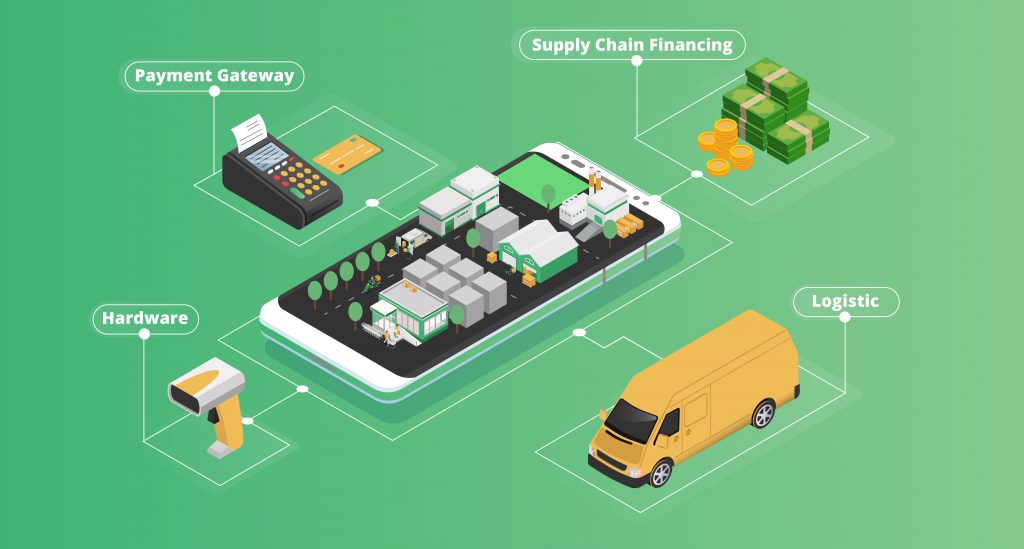

Unlock Countless Possibilities in Your Supply Chain with Advotics (& Our Partners!)

B2B partnership is aimed to bring stronger success for both parties as well as their clients. Take the e-commerce business for example, after the marketplace partnered up with banks and digital wallets to support its payment gateway. Stores now don’t need to approach each bank individually to set up their payment gateway.

Stores won’t start from zero each time they want to partner up with a bank because by joining the marketplace they are automatically partnered up with multiple banks. This established connection from the marketplace is minimizing resources and operation costs. For example, payment issues can be resolved by the marketplace or straight to the bank. Stores don’t need a big designated internal team to resolve it anymore.

As manufacturers seek to meet distributors’ and resellers’ needs, Advotics is innovating by integrating our current system with third-party solutions. This program aims to open up a lot of new and exciting possibilities for the whole Advotics’ user ecosystem.

The Solutions:

Some principles and distributors supply thousands of retail stores throughout the country. If they have to check every payment, match amounts, and reconcile them manually, the process would be painfully slow. On the other hand, some retailers may already be thinking of using a digital payment channel other than through the banks.

Advotics now partner up with third-party payment gateways where we connect your purchase order & invoice so that users can proceed with payment.

A payment gateway can easily recognize inbound payment and reconcile the invoice in one system. Order fulfillers (Principal or Distributor) don’t have to find and match the amount numbers manually anymore as the system will tell you the reconciled amount and reconciliation result.

This type of payment method also helps to broaden buyer experience. Now buyers can feel safer because they receive their receipt right away and can pay through multiple payment channels for transactions (bank transfer, credit card, digital wallet, etc).

Unfortunately, for some retailers or buyers, liquidity may become a problem to fund new sales orders. A traditional route, such as through bank loans will require complex requirements and a slower process.

Principals may not be in a position to provide longer terms of payment, but they can provide accurate payment invoices. These history transactions will act as a guarantee for the loan. Advotics now partners up with OJK licensed financing partners, where retailers can access additional funds for their purchase orders.

Our financing partner will provide a funding solution with an extension in payment term, of up to 3 months. This program will increase the client’s purchasing power in the hope to boost their sales performance.

Our financing partner also understands that time is money, which is why they have a faster and more flexible assessment process. They even don’t require any asset collateral because the system simply uses the client’s transaction records and invoices from Advotics platforms.

-

Logistic Partner

Companies may already have their internal fleet to deliver the product. However, when they get a fluctuation of order, sometimes they will need backup trucks. Advotics’ partnership with Third Party Logistic (3PL) provider will be able to equip them with all the delivery fleets they need, including a certified operator.

If in the long run, they end up saving more by using our logistic partner’s fleet, they may fully dive in and use the third party fleets fully. This system can be an alternative to minimize operational costs.

On the other hand, there would be seasons or times where companies’ internal fleets (tractor, forklift, truck, car) or even warehouse space are idle. This is an opportunity for companies to fully utilize it by lending it to the 3PL partner, where they would share it to the shipper or other companies who need fleets or space. In return, the company would get shared revenue from the 3PL.

Kamagra est un médicament générique du Viagra, fabriqué par https://proprepharmacie.com/. Kamagra délivre le même principe actif que le Viagra (sildénafil), mais à un prix moins élevé. Les comprimés de Kamagra peuvent être pris indifféremment avec ou sans repas.